HILFSCENTER

Basics of Economics 3 – Slippage

Veröffentlichen um 2022-03-10

Slippage refers to the difference between the expected price of a trade and the price the trade is executed at.

For example, trader A intended to buy 1 BTC at 40,000 USDT, but the trade order was filled at 40,050 USDT. The price spread between the trade’s intended price and executed price is called slippage.

Slippage occurs in all market venues, including equities, bonds, forex, futures, and crypto. Slippage can occur at any time but is most prevalent during the hours of high market activity, in markets with high volatility, or when large market orders are executed.

Slippage Types

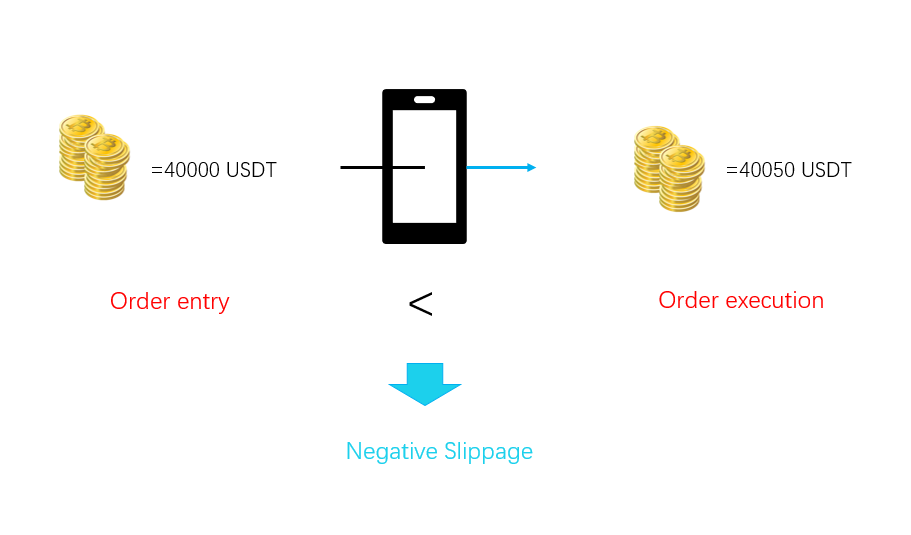

1. Negative slippage: It occurs when a trade order is filled (executed) at a price greater than the expected price.

For example, trader A intended to buy 1 BTC at 40,000 USDT, but the trade order was finally filled at 40,050 USDT, 50 USDT higher than anticipated. Trader A paid 50 USDT more than expected for the trade, which is a negative slippage.

The occurrence of slippage can disrupt established trading strategies, pushing up trading costs. Taking the “upside trend” trading as an example, due to the failure of entry at the intended price, higher costs must be paid to gain quick entry to the market. Therefore, slippage is also considered a trading cost, or a slippage cost. As far as a slippage cost is concerned, it refers to negative slippage.

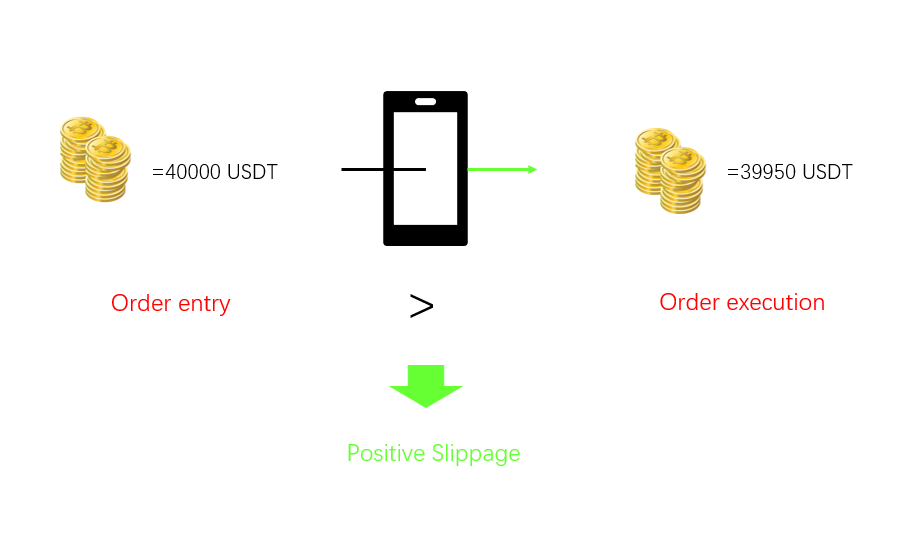

2. Positive slippage: It occurs when a trade order is filled (executed) at a price lower than the expected price.

For example, trader A intended to buy 1 BTC at 40,000 USDT, but the trade order was finally filled at 39,950 USDT, 50 USDT lower than anticipated. Trader A paid 50 USDT less than expected for the trade, which is a positive slippage.

A positive slippage could occur whether market orders or limit orders are used, especially when countertrend trading strategies are adopted.

Why does a Slippage Occur?

By definition, slippage occurs due to the difference between the expected price of a trade and the price at which the trade is executed. Understanding why there is a difference between the two prices is the key to discerning the occurrence of slippage. Let’s dive deeper into the two key factors that determine slippage, the expected price (the way a trader places an order) and the executed price (the way the trade executes the order).

From the perspective of the expected price, a slippage occurs when a trader uses market orders. Asset prices in trading markets are determined by both buyers and sellers. Sellers must find matched buyers (counterpart) for their trades. The imbalance between buyers and sellers can lead to the fluctuations in asset prices. Due to fast-moving asset prices, it’s inevitable for slippage to occur during the time gap between the placement and execution of an order.

From the perspective of the executed price, the occurrence of slippage can be simply based on the instability of the trading environment for order execution, which is mainly due to: 1. Network latency led by strong market fluctuations. It is common that the conditions of software and hardware for transaction execution are unstable, and sharp price fluctuations may lead to a latency between the trading system and the trade server. 2. The announcement of major events, which can increase the chances of investors experiencing slippage. For example, when important economic data is released, the trading markets will respond quickly, incurring strong price fluctuations in a short period of time. It is difficult for traders to get in and out at the price they want. 3. Not enough liquidity available in the markets. In a market with high liquidity, quotations are stable and continuous, while in a market without enough liquidity, it’s common to see high market volatility and sharp price fluctuations. 4. A specific trading strategy can also lead to a slippage. For example, both buyers and sellers will suffer from slippage when they trade in different direction. Especially when a trader makes a trade for a breakout entry (for instance, the price breaks above a moving average and a upside trend is confirmed), it’s more likely that the trade will be filled at the intended price due to short-term sharp price movements caused by a huge influx of numerous traders in a short time.

How to Minimize Impact of Slippage?

Slippage occurs in all markets and no orders or instructions can be used to fully eliminate slippage. However, some methods can be utilized to minimize the impact of slippage, namely managing trading costs within an acceptable range.

1. Investors can utilize limit orders rather than market orders. From the aspect of order types, the best way for investors to eliminate or reduce slippage is placing limit orders, because a limit order only fills at the price you want, or better. However, it only works if the price reaches the limit you set, and if there is a supply of the stock available to buy at the time it reaches your price, which means there are no guarantee for the execution of a limit order. Limit orders have risks for traders who adopt some specific trading strategies, because it means they will break the trade order once the limit order is not filled. Therefore, traders could add an extra instruction beyond placing a limit order, namely turning the limit order to a market order if its execution fails.

2. Don’t trade during or around major events. As mentioned above, when major events such as important economic data is released, the trading markets will respond quickly, causing large price fluctuations in a short period of time, so traders should not place a market order during or around these special event periods.

3. Trade in markets with low volatility and high liquidity. Low volatility means stable price movements, which can ensure the execution of an order with a stable price. High liquidity means significant market activity, which can ensure a high order fill rate. Therefore, slippage risks can be effectively reduced in markets with low volatility and high liquidity.

4. Set the executed price range and fill orders within the market price range. This approach is commonly seen in the traditional foreign exchange market. In the crypto space, it is more prevalent in the DeFi sector. For example, some decentralized exchanges can set the acceptable slippage range. By doing so, investors can set an acceptable price range for filling an order, and if the order cannot be executed at the selected price range, the order will be cancelled, and no position will be opened. The larger the selected range, the greater chance of execution of an order.

It needs to be noticed that slippage is unavoidable for market orders and traders are susceptible to a negative slippage. Therefore, traders need to take slippage into account in their overall trading costs. Slippage costs should also be considered during the review of trading strategies. By accounting for slippage traders can more effectively test the feasibility of the trading strategies.