What is Time in Force (TIF)?

Time in force (TIF) is a specified order parameter when users place an order, used to specify how long an order will remain active or open before it’s executed or it expires. It’s a significant factor for an order model. Different TIF parameters means different order execution strategies.

What are GTC/IOC/FOK Orders?

1. Good Till Cancelled (GTC)

Good Till Cancelled (GTC): The order will remain valid until it is fully executed or manually cancelled by the trader.

For example: A trader wants to buy 1 BTC at 10,000 USDT. If the trader uses GTC to execute the order, the order will remain open untill the market price of BTC satisfies the condition of 1 BTC equal to 10,000 USDT, or the order will be closed manually.

The GTC order can be flexibly cancelled at any time before it’s executed or has its unconcluded contracts cancelled after part of the order was filled. GTC is suitable for traders who are willing to wait for all contracts to be completed at a specified price. Unlike the automatic order cancellation at the closing of the stock market, the crypto market is running 24/7, so GTC is also a default option for limit orders on crypto trading platforms.

2. Immediate or Cancel (IOC)

Immediate or Cancel (IOC): The order must be partially filled immediately at the order limit price or better, and the unfilled contracts will be cancelled. If the order cannot be fully filled immediately, the order will be also cancelled.

For example: you wish to buy 10 BTC at 10,000 USDT. The IOC order can just buy 8 BTC at 10,000 USDT in the current market situation. If you buy the 8 BTC, the unfilled order for 2 BTC will be cancelled. If the order can’t be immediately matched with the order on the book at the desired execution price, the order will be also cancelled.

With the IOC strategy, all the quotes available on the market will be compared with the order limit price, which is essentially a buy or sell strategy regardless of cost. In traditional markets, it’s used to fight against daily limits, which is commonly understood as "buy or sell as many as you can". In the crypto market, this strategy is often used to buy or sell in time based on a specific order limit price.

3. Fill or Kill (FOK)

Fill or Kill (FOK): The order must be immediately and fully executed at the order price or better, otherwise, it will be completely cancelled. Different from IOC, FOK can only be fully filled or cancelled, and partially filled contracts is not allowed.

For example: you wish to buy 10 BTC at 10,000 USDT. The FOK order can just buy 8 BTC at 10,000 USDT in the current market situation. If the order can’t be immediately and fully filled, the order will be also cancelled.

Generally speaking, the FOK strategy is a limit order mechanism for professional trading scenarios. It’s more sensitive to trading volume instead of price, because traders may suffer a sharp decline in profits from the order, or even a loss, if it can’t be filled immediately and fully at a specific limit price. This execution strategy is more commonly used by scalping traders, day traders or option contract traders looking for short-term market opportunities. It is also a viable option in a market with poor liquidity.

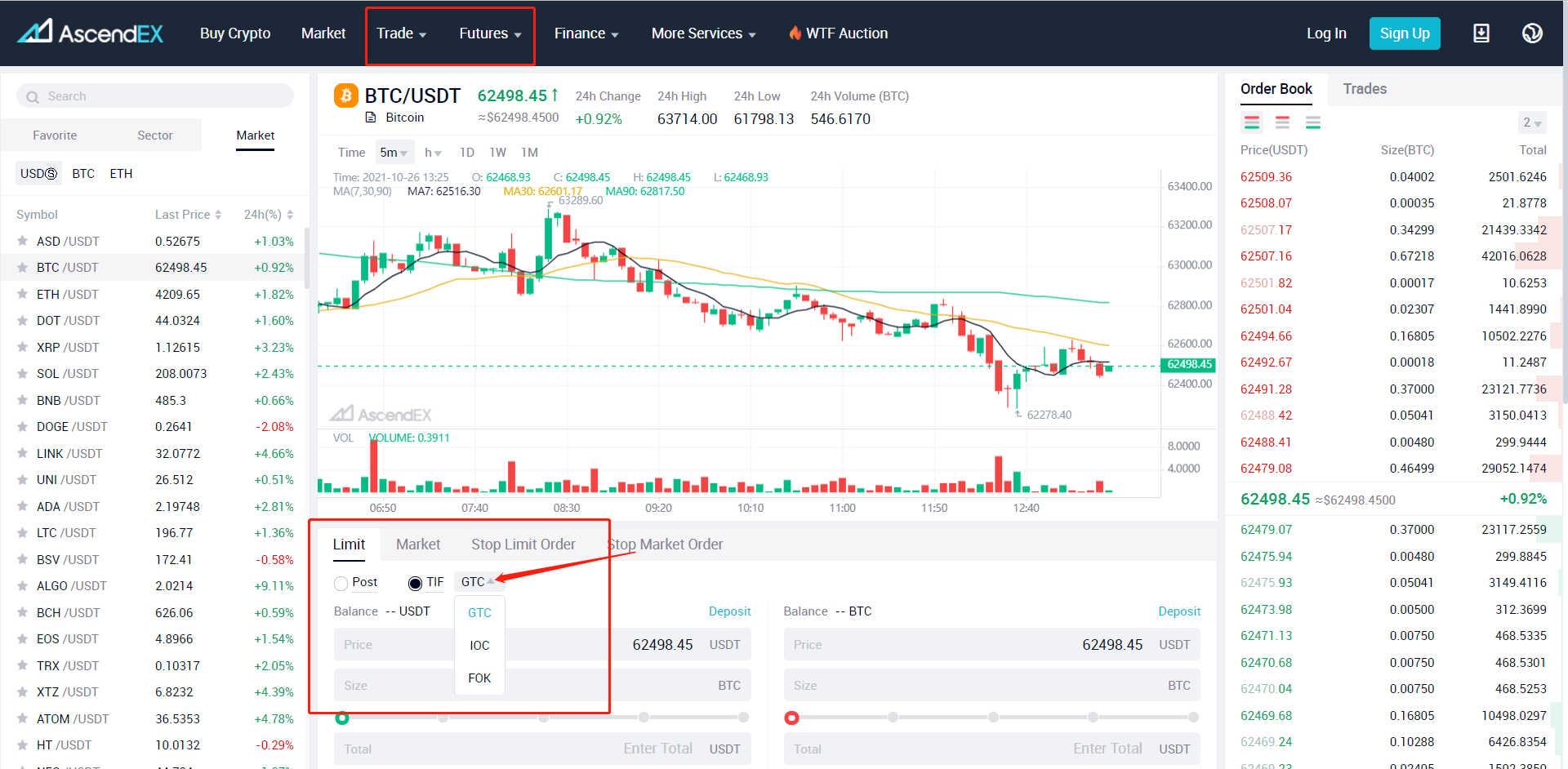

GTC/IOC/FOK Orders Setting

PC Clients: Cash/margin/futures trading details pages