What is Forced Liquidation?

Forced liquidation is a risk management mechanism implemented when market fluctuations cause a significant decline in the value of a user's account assets, potentially even leading to negative equity. Specifically, when users perform futures trading, they are required to hold certain margin in their accounts to maintain their current positions. This margin is also known as maintenance margin. When the user's margin fails to meet the maintenance margin requirement, their position will be liquidated, or forcibly closed, resulting in the loss of all the margin used for that position.

Terms related to forced liquidation for a better understanding:

Futures Margin: The amount of margin required to maintain a futures position.

Initial Margin: The minimum amount of margin required to open a futures position.

Maintenance Margin: The minimum amount of margin required to maintain a futures position.

Margin Balance: Total margin + unrealized PnL

Margin Ratio: Maintenance margin / Margin balance

Note: Different futures trading pairs require varying requirements for margin. You can refer to Contract Info > Margin Requirements for details. Moreover, you can read Introduction to Perpetual Futures Contracts Margin to learn more about margin.

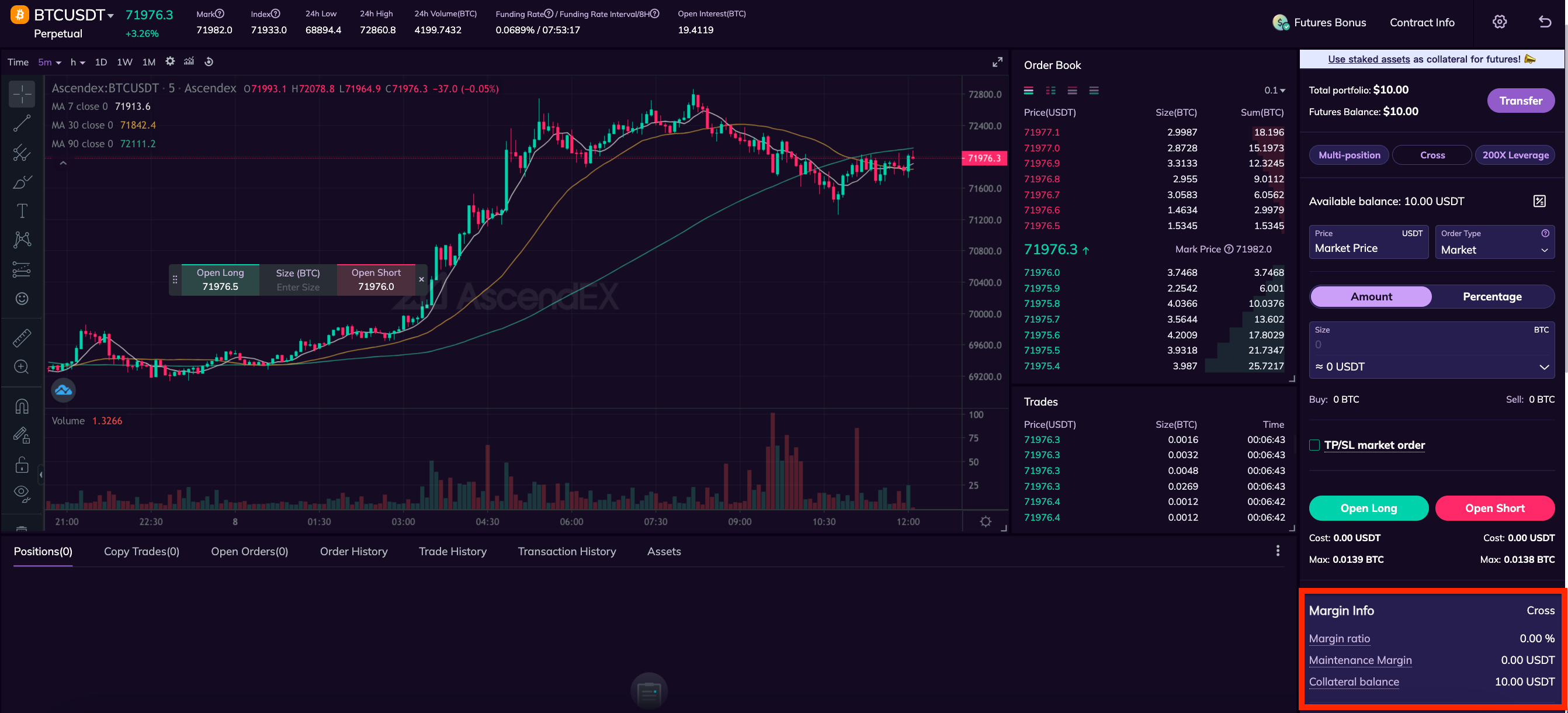

Taking AscendEX’s BTCUSDT perpetual futures as an example. Suppose you have 5000 USDT in your Futures account. You plan to open a long position for BTCUSDT with leverage of 25X at a price of 50,000 USDT, with a position size of 1. According to AscendEX’s margin requirement for BTC perpetual futures, the initial margin rate for a 25X leveraged BTC position is 4%, and the maintenance margin rate is 2.4%.

If the BTC price subsequently fluctuates by a percentage of X, the margin details of your current position will be as follows:

Price Movement | Initial Margin | Maintenance Margin | Margin Balance | Margin Ratio |

Up | 50,000*4%=2,000 USDT | 50,000*2.4%=1,200 USDT | 5,000+50,000*X | 1,200/(5,000+50,000*X) |

Down | 50,000*4%=2,000 USDT | 50,000*2.4%=1,200 USDT | 5,000-50,000*X | 1,200/(5,000-50,000*X) |

When Does Forced Liquidation Occur?

Forced liquidation occurs when the margin amount in a user’s Futures account fails to meet the maintenance margin requirement. The specific conditions are as follows:

Margin balance of the position ≤ Maintenance margin; or Margin ratio reaches 100%

Continuing the above example of the BTC perpetual futures. Once the margin balance of your position ≤ maintenance margin, i.e. 5,000 ± 50,000 * X ≤ 1,200 USDT, or when the margin ratio of the position reaches 100%, i.e. 1,200 / (5,000 ± 50,000 * X) = 100%, your BTC position will be forcibly closed.

Therefore, in this example, if the BTC price fluctuates by 7.6%, the position will be forcibly liquidated:

Position | Initial Margin | Maintenance Margin | Forced Liquidation Price |

Short | 2,000 USDT | 1,200 USDT | 53,800 USDT |

Long | 46,200 USDT |

To avoid unnecessary losses caused by forced liquidation, please pay close attention to changes in the Futures account's margin and promptly add margin if necessary to manage position risks.

Note: The calculations above do not consider complex factors such as futures trading fees and funding rates.

Forced Liquidation Price

AscendEX uses the mark price as a reference for the forced liquidation price to avoid forced liquidations caused by insufficient market liquidity or market manipulation.

If a futures position is forcibly liquidated, you can check the liquidation record and liquidation price on the futures assets page.

Forced Liquidation Process

When the margin balance falls below the maintenance margin requirement, the Futures account incurs the automatic liquidation process. AscendEX's perpetual futures liquidation system performs the following operations:

(1) Preparing for account liquidation.

(2) Perform position reduction through smart order routing.

(3) (If necessary) Sell positions to the backstop liquidity provider (BLP).

(4) (If necessary) Sell positions to the top 10 counterparties (automatic reduction of counterparties' positions).

(5) Return account control to the user.

(1) Account Liquidation Preparation

All open orders in the Futures account are canceled. Functions such as withdrawals, trading, and automatic settlement of unrealized PnL are disabled. All non-USDTcollateral is converted to USDT. No orders can be placed before the completion of liquidation.

(2)Position Reduction through Smart Order Routing

Orders for closing positions are placed via smart order routing within the amount limit to manage down position risks.

Note: The position reduction speed and the number of liquidation orders per batch set by the platform system are designed to minimize the impact on the market by avoiding significant sell-off (referred to as "slippage") caused by liquidated positions. At the same time, during the liquidation process, as long as the account's margin ratio reaches higher than the initial margin rate, the liquidation will stop, and the control of the account will be returned to the user.

(3)Selling Positions to BLP

If the smart order routing reaches the maximum limit of liquidation orders (approximately 50 rounds) and the account's margin ratio is still lower than the maintenance margin rate, the remaining positions in the account will be sold to the BLP. The price at which each contract is sold is referred to as the liquidation price (also known as the bankruptcy price), even if the account value is zero.

For more details, please refer to Backstop Liquidity Provider Program.

(4)ADL

If the BLPs cannot provide sufficient liquidity, the remaining positions will be allocated proportionally to the top 10 counterparties. This process is also known as automatic deleveraging (ADL).

Note: Each futures position sold to the BLP or returned to the user through automatic deleveraging is priced based on the BLP's selling price. When the account value is greater than 0, the BLP and the insurance fund will receive a proportionate share of the positive balance based on the BLP's account balance allocation ratio. When the account value is less than 0, the BLP and the insurance fund will compensate for the negative equity based on the BLP's worst price deviation. If the insurance fund balance is insufficient when the account has negative equity, the platform will extract funds from the user’s accounts with unrealized PnL to compensate for the platform's losses.

(5)Completion of Liquidation

After the forced liquidation is completed, the services including withdrawals, trading, and automatic settlement of unrealized PnL will be resumed. Users can restart opening positions in the futures market.

Risk Reminder: Futures products come with certain risks while offering high returns. When participating in futures trading, please closely monitor changes in margin and promptly add margin if necessary to manage down risks, to avoid unnecessary losses from liquidation triggered by market fluctuations.