YARDIM MERKEZİ

Only 5 Minutes to Understand Leveraged Token!

2023-05-22'da yayınlayın

I. What Are Leveraged Tokens?

A leveraged token is essentially a fund designed to track the price movements of an underlying asset by using financial derivative instruments (such as futures) with the aim of amplifying the returns of the underlying asset. When the return of the underlying asset increases or decreases by 1%, the net value of the leveraged token will change accordingly at a rate of 1.5%, 2% or 3%. When the leverage ratio is 1, the leveraged token is effectively equal to a regular cryptocurrency.

Leveraged tokens track a single crypto token as the underlying asset and multiply the returns of the underlying asset. Take AscendEX’s leveraged tokens BTC3L and BTC3S as an example—if the BTC price increases by 1%, then BTC3L will increase by 3%, while BTC3S will decrease by 3%.

Ⅱ. How Do Leveraged Tokens Work?

A leveraged token is essentially a fund!

so leveraged tokens are effectively funds operated by professional financial teams. Each leveraged token corresponds to some futures positions. Fund operators conduct dynamic adjustments on futures positions through a rebalancing mechanism to maintain a target leverage for the net value of a leveraged token in a given time period on a daily basis. Thus, the returns of the underlying asset are amplified according to the trade.

So, how is this effect or goal achieved? Here we have to mention the core mechanism to maintain the operation of the leveraged token system - the rebalancing mechanism. The rebalancing mechanism includes regular rebalancing and temporary rebalancing.

Regular Rebalancing - at 2:30 a.m. UTC every day

By daily tracking the leverage level of a leveraged token based on the market movements, the leveraged token is rebalanced at a specified time every day. This means the fund assets are liquidated every day at a specified time and a new leverage ratio for the fund will be recalculated based on the adjusted net value to closely track the target leverage.

Suppose the net value of a BTC leveraged token is 100 USDT and the futures positions of the BTC leveraged token with 3X leverage for the underlying asset are 3 BTC. This would result in futures positions that are worth 300 USDT. Suppose an investor buys 1 BTC3L for 100 USDT, then the BTC price of the day rises 5%, which would result in an increase of BTC3L’s net value by 15%. At this point, the BTC price is at 105 USD and the BTC3L holdings of the investor are worth 115 USD in net value. The corresponding futures positions would be valued at 315 USD. The price change leads the real leverage of BTC3L to change to 315/115=2.74, rather than the target leverage of 3X. Therefore, an extra 30 USD worth of positions need to be added to the futures positions of BTC3L to maintain the target level of 345/115=3. Similarly, if the underlying asset price falls, the futures positions need to be downsized to maintain the target leverage.

Temporary Rebalancing - time is not fixed

Temporary rebalancing is a risk measure adopted to deal with extreme market conditions. Except that the rebalancing time is not fixed, its basic operating principle is exactly the same as that of regular rebalancing.

If the market fluctuates abruptly and the price swing range of the underlying asset exceeds the given range set at the previous rebalance point, the platform will make a temporary rebalance to reduce trading risks. The temporary rebalance only targets the leveraged products that suffer losses due to market fluctuations.

Ⅲ. About the Price Mechanism of Leveraged Tokens

At present, AscendEX mainly supports leveraged tokens with 3X and 5X leverage, and its price mechanism is based on the rebalancing mechanism.

Formulas for calculating the net asset value of AscendEX leveraged tokens:

3x leveraged tokens: Net asset value = the net asset value at the previous rebalancing point*[ 1±3*(the latest price of the underlying asset-the price of the underlying asset at the previous rebalancing point)/ the price of the underlying asset at the previous rebalancing point *100%]

5x leveraged tokens: Net asset value = the net asset value at the previous rebalancing point*[ 1±5*(the latest price of the underlying asset-the price of the underlying asset at the previous rebalancing point)/ the price of the underlying asset at the previous rebalancing point *100%]

Ⅳ. Net Value Split and Merge

To lower the trading access, increase the net value sensitivity of leveraged tokens and optimize trading experience, AscendEX will irregularly perform a share split or merge for the net value of leveraged tokens. Users will be informed through official announcements.

The specific process is as follows: issue trading suspension notice at 2:00 p.m. UTC; suspend trading at 2:30 p.m. UTC; resume trading at 3:00 p.m. UTC. With a share merge or split, the number of the leveraged token shares held by users and the unit value per share will change, but the total value of users’ holdings will not change.

For instance, you buy 100 shares of BTC3L with a net value of 1 USDT. A BTC price rise pulls the net value of a BTC3L share up to 10 USDT, meaning the total value of your BTC3L holdings is 10*100=1000 USDT. Due to the overhigh net value, the platform performs a share split on BTC3L, sending its net value down to 2 USDT, thus increasing the number of your BTC3L shares to 500. Despite a lower net value for BTC3L, your total holding value is still at 2*500=1000 USDT.

Details rules on the net value share split and merge of AscendEX’s leveraged tokens:

When the net value of a leveraged token after rebalancing is lower than a set level, the platform will perform a share merge for the leveraged token, namely that the number of the leveraged token shares held by users will become 1/N that before the merge, and the unit value will be N times that before the merge.

When the net value of a leveraged token after rebalancing is higher than a set level, the platform will perform a share split for the leveraged token, namely that the number of the leveraged token shares held by users will become N times that before the split, and the unit value will be 1/N that before the split.

Please note, during the split or merger period, AscendEX will halt the trading of effected tokens to protect user benefits, and pending orders are cancelled. After the split or merger is completed, users need to place their orders again.

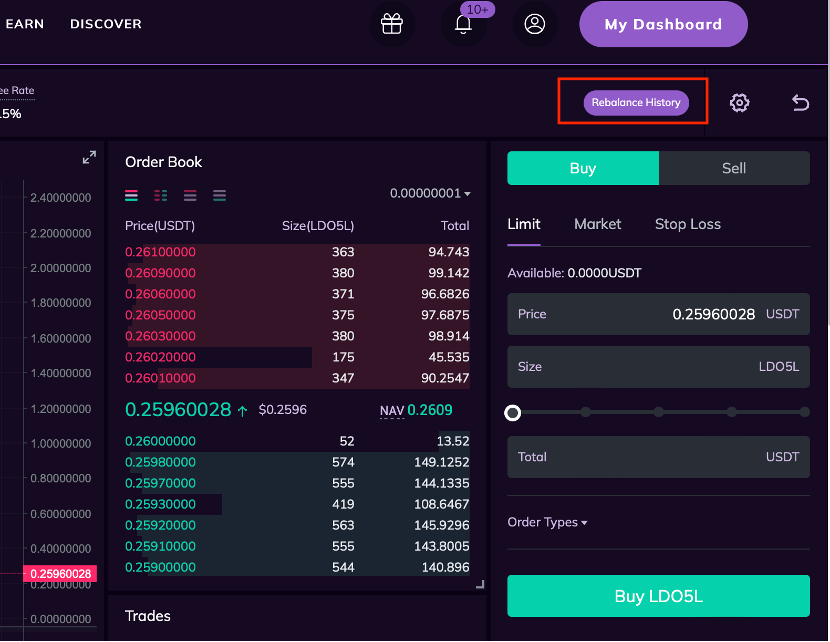

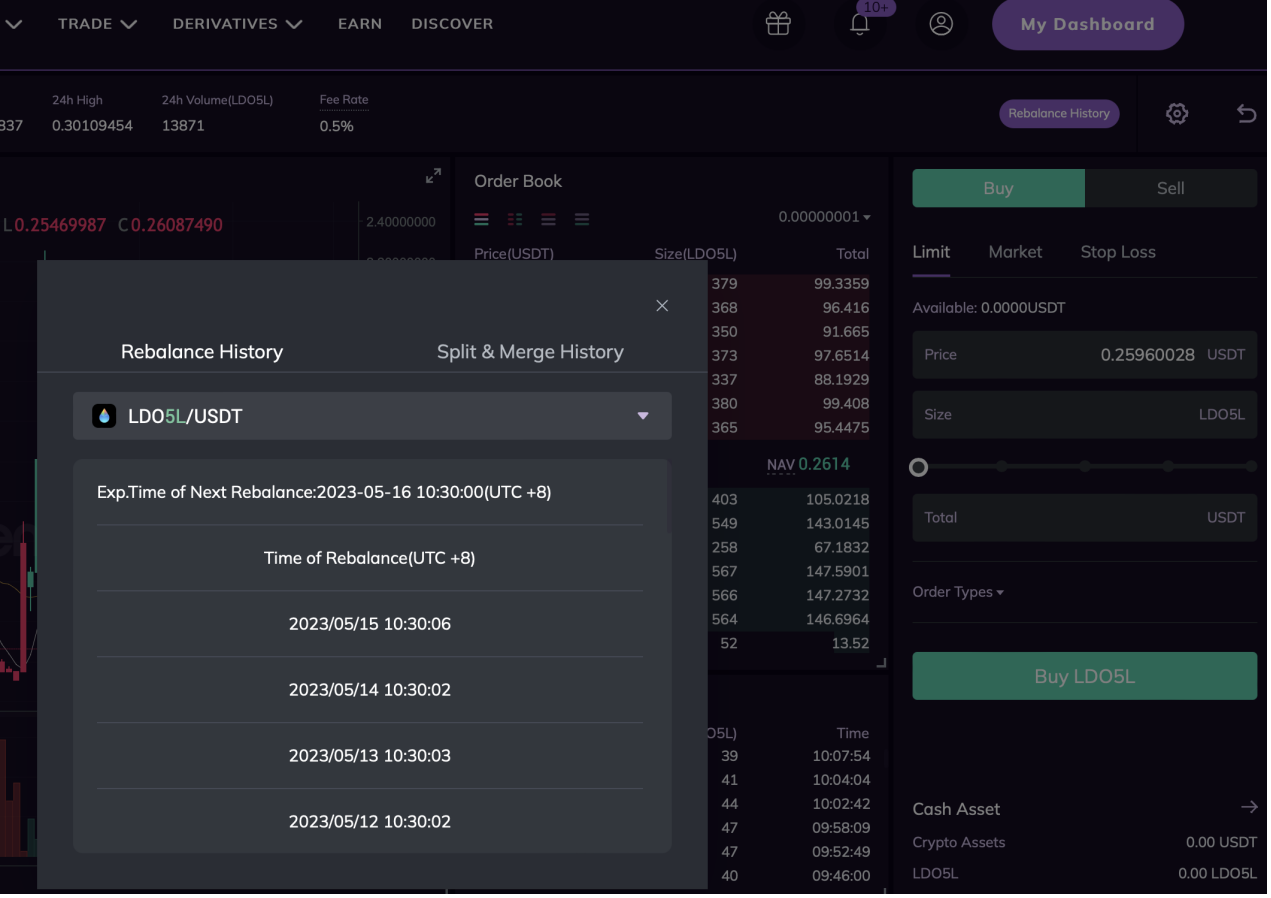

Users can go to the trading page of the corresponding leveraged token, and click on the "Rebalance History" button to view the rebalance and split/merger records.

Ⅴ. How to trade leveraged token?

Leveraged token track a single crypto token as the underlying asset and multiply the returns of the underlying asset. It has a trading mechanism similar to spot trading. Please see further details below:

1.Users are allowed to trade leveraged tokens at any time without having to put up any collateral.

2.The naming rule of leveraged tokens: underlying asset + leverage + the side of trade. Take BTC3L as an example, BTC is the underlying asset, 3 means 3X leverage, L stands for going long on the market.

3.At present, mainstream platforms generally support leveraged tokens with 3X and 5X leverage. For instance, AscendEX’s leveraged tokens generally offer 3X and 5X leverage.

To help you understand better, the BTC leveraged token variety will be used as an example here. For instance, with BTC as the underlying asset, users can choose to trade leveraged tokens BTC3L and BTC5L in long positions, or BTC3S and BTC5S in short positions. If you buy BTC3S or BTC5S, it means you are short on the market. If the BTC market declines as expected, the net value of BTC3S and BTC5S will go up. Likewise, if the BTC market rallies against expectations, the net value of BTC3S and BTC5S will decline.

Ⅵ. More details to pay attention to when trading leveraged token

(1) When trading leveraged tokens, you are buying and selling fund shares, not spot cryptocurrencies.

Although the trading mechanism of leveraged tokens is similar to spot trading, leveraged tokens are funds in nature. When investors buy or sell leveraged tokens, they are trading the fund shares of the corresponding leveraged token, not spot cryptocurrencies. Similarly, the price of leveraged tokens does not reflect the price of spot cryptocurrencies but rather the net asset value of the corresponding leveraged token.

Let's take AscendEX’s leveraged token BTC3L for example. Assume you purchase 300 BTC3L at the price of 1 USDT each, which means you are holding BTC3L worth 300 USDT. In this example, the 300 USDT worth of BTC3L is not equivalent to 300 USDT worth of spot BTC, but rather represents the fund shares of BTC3L. Similarly, the price of 1 USDT is not the price of spot BTC but rather the net asset value of BTC3L.

(2) Understanding the price mechanism of leveraged tokens

The price mechanism of leveraged tokens is based on rebalancing. The price of leveraged tokens always moves with the spot price at the last rebalancing, not the spot price at the time of purchase.

(3) Leveraged tokens are more suitable for one-sided markets and may experience losses in range-bound markets

Leveraged tokens amplify the daily price movements of their underlying assets through rebalancing. When the price of a leveraged token increases, the corresponding fund leverage falls below the target leverage, prompting the fund manager to increase the hedge futures positions to raise the fund leverage. Conversely, when the price of a leveraged token decreases, the fund leverage exceeds the target leverage, and the fund manager needs to reduce the hedge futures positions to lower the portfolio leverage.

In the upward market, the rebalancing and repositioning will generate a compounding effect similar to futures rollover. However, in a range-bound market, the underlying asset price may fluctuate back to its original level, but the account net value of leveraged token holders may decrease, resulting in what is known as fund losses. Therefore, leveraged tokens are more suitable for one-sided markets and should be used as short-term hedging tools rather than as long-term ones.

For details of the compound effect and fund losses of leveraged tokens, you can refer to Trading Scenarios Applicable to AscendEX’s Leveraged Tokens.

Ⅶ. Advantages of Leveraged Token

1. No Collateral and High Utility of Fund

Compared with regular crypto margin and futures trading, users have a higher utility of fund while trading leveraged tokens. This is because leveraged token trading requires no collateral as spot trading. No positions being used by collateral helps increase the utility of fund.

2. Easy operations and Higher Returns

Leveraged tokens are traded using the same mechanism as spot trading. Users can easily trade leveraged tokens by simply going short or long on their target tokens without other operations required.

Leveraged token trading can be conveniently understood as spot trading in terms of trading mechanism. Compared to spot trading, leveraged tokens come with in-built leverage, and users do not need to manage margin or collateral while using leveraged positions to multiply their returns. Therefore, leveraged tokens have more advantages over spot or margin token trading.

3. Compound Effect

The rebalancing mechanism ensures a compound effect on leveraged token trading when the market keeps moving up or down in one direction. With the mechanism, earnings from the holdings of leveraged positions will be automatically redelegated to the positions after a daily rebalancing event. As such, users can leverage the compound effect to earn higher returns in a one-sided market. This means that leveraged tokens are a perfect fit for a trending market.

4. No liquidation and manageable risks

In theory, leveraged token trading has no liquidation risks due to its feature of needing no collateral for trading.

Risk Disclosure: As an emerging financial derivative, theoretically, there is no liquidation risks for a leveraged token. However, with incorrect trend predictions, there will be a risk that the net asset value of a leveraged token approaches 0 amid extreme market conditions. Please fully understand the rules before engaging in leveraged token trading and be cautious to reduce potential risks.