ศูนย์ช่วยเหลือ

Easy Options Manual

เผยแพร่เมื่อ 2023-07-31

(1)Introduction

1. Introduction to Easy Options

Welcome to Easy Options, the newest addition to AscendEX's suite of trading services. Easy Options is a simplified option trading product designed to offer an accessible and easy-to-understand way for traders to speculate on the price movements of digital assets. With Easy Options, traders can select from a variety of contracts based on different assets, strike prices, and settlement periods. Unlike conventional option products, Easy Options offers a straightforward and intuitive way to understand when an option will be exercised, with only two possible outcomes: either the option expires in the money and earns a fixed payout, or it expires out of the money and earns nothing at all. With our user-friendly platform and transparent fee structure, Easy Options makes trading options accessible to both novice and experienced traders alike. We invite you to experience the simplicity and convenience of Easy Options, and discover a new way to trade digital assets with confidence.

2. Understanding the Easy Options Market

Easy Options are based on a variety of underlying cryptocurrency assets, such as bitcoin, and Ethereum, and are designed to be more accessible and straightforward for traders of all levels of experience.

The relationship between the price of the underlying asset and the option price is an essential element of the Easy Options Market. Easy Options are priced based on the current market price of the underlying asset, the strike price of the contract, and the time until expiration. As the price of the underlying asset moves, the price of the option will move in response. Traders need to understand how the price of the underlying asset is likely to move in order to make informed decisions about which contracts to buy and sell.

The payout structure of Easy Options is based on the price movements of the underlying asset by the settlement period, which, for long-term options, is a 30-minute period prior to the beginning of each trading day (8:00 AM UTC); and for short-term options, is the moment the option expires. It is important to note that the Easy Options market is subject to the same market volatility and regulatory landscape as other digital asset markets.

3. Types of Easy Option

Easy Options offers a range of contracts with varying underlying assets and strike prices, as well as expirations to suit different trading strategies and risk appetites. Traders can choose from Bullish or Bearish options contracts, each of which offers a different payout structure based on whether the underlying asset price is above or below the strike price at settlement.

Easy Options offers 2 classes of options based on their expiration dates and times.

Intraday options: also referred to as short-term options, are a class of options that have a lifecycle of less than 24 hours, providing traders with the opportunity to capitalize on short-term market movements. These options, such as the 30-minute options, offer a faster-paced trading experience, where traders can quickly enter and exit positions within a shorter timeframe.

Multiday options: also known as long-term options, on the other hand, provide traders with a longer expiration period of at least 24 hours. These options allow for more extended time horizons, enabling traders to take advantage of potential price movements over a more extended period. With multiday options, traders have the flexibility to hold positions for multiple trading sessions, giving them more time to analyze market trends and make informed decisions.

Bullish options contracts are designed for traders who expect the price of the underlying asset to rise above the strike price by the end of the expiration time (for multiday options, the end of expiration time is considered to be at 7:59:59AM UTC; and for intraday options, the end of expiration time is the last moment of its lifecycle). If the underlying asset's price exceeds the strike price at settlement, the contract will expire in the money, and the trader will receive a fixed payout or $1 per contract share.

Bearish options contracts, on the other hand, are for traders who expect the price of the underlying asset to fall below the strike price by the end of the expiration time. If the underlying asset's price remains below the strike price at settlement, the contract will expire in the money, and the trader will receive a fixed payout of $1 per contract.

Each Easy Options contract follows a naming convention that signifies important details of the contract. The first part of the name denotes the underlying asset, followed by the expiration time in the format of DATEMONTHYEAR for multiday options, and DATEMONTHYEARHOURMINUTE for intraday options. The next part is the strike price of the option. Finally, the option type is represented with "CALL" or "PUT" for bullish or bearish options respectively. For example, "BTC-6APR23-28000-CALL" represents a bull (a.k.a. call) option with BTC as the underlying asset, an expiration date of April 6, 2023, and a strike price of 28000; "BTC-6APR231130-28000-PUT" represents a bear(a.k.a put) option with BTC as the underlying asset, and expiration time of April 6, 2023 at 11:30 UTC, and a strike price of 28000.

It is important to note that each type of Easy Options contract has its own unique payout structure and level of risk, and traders should carefully consider their investment objectives and risk tolerance before entering into any position.

Examples

Bullish option:

Suppose a trader purchases a Bullish option with a strike price of $50 for an underlying asset currently trading at $45. The option price is $0.2 per share. If, by the end of the trading day, the underlying asset's price rises above the strike price of $50, say $56.7, the option will expire in the money, and the trader will receive a fixed payout of $1 per contract. Therefore, if the trader bought 10 contracts for $2 ($0.2 per contract x 10 contracts), and the option expires in the money, they will receive a payout of $10, resulting in a return rate of (10 / 2 - 1) x 100% = 400%. However, if the price of the underlying asset remains below the strike price of $50 at settlement, for example, $49.99, the option will expire out of the money, and the trader will lose the entire $2 investment.

Bearish option:

Suppose a trader purchases a Bearish option with a strike price of $50 for an underlying asset currently trading at $48. The option price is $0.8 per share. If, by the end of the day, the underlying asset's price remains below the strike price of $50, the option will expire in the money, and the trader will receive a fixed payout of $1 per contract. Therefore, if the trader bought 10 contracts for $8 ($0.8 per contract x 10 contracts), and the option expires in the money, they will receive a payout of $10, with the return rate being ($10 / $8 - 1) x 100% = 25%. However, if the price of the underlying asset moves above the strike price of $50 at settlement, the option will expire out of the money, and the trader will lose the entire $8 investment.

Again, it's important to note that these examples are for illustrative purposes only and actual option prices and payouts may vary based on market conditions and other factors (see sections 8, 9, and 10 below). Traders should carefully consider all risks and rewards before investing in Easy Options.

4. Funding Your Easy Options Account: Deposit and Withdrawal

To start trading easy options, you will need to fund your account with USDT. To deposit, simply navigate to the "Wallet" section on the platform, choose the amount you want to deposit, and follow the instructions to transfer USDT to your Options Account. Once your deposit is confirmed, the funds will be credited to your account and you can start trading immediately.

To withdraw funds, also go to the "Wallet" section on the platform and enter the amount you wish to withdraw from the Options Account and specify the recipient account to which the amount wishes to be transferred. Once the request is processed and approved, your funds will be transferred to your account. Please note that withdrawal requests may take up to 24 hours to process.

Please also note that AscendEx will not charge any transaction fees between one's internal accounts.

5. Choosing the Right Contract

Choosing the right Easy option is an important part of successful trading. When selecting a contract, you should consider the current price of the underlying asset and the market conditions. A bullish contract is appropriate when you expect the price of the underlying asset to rise above the strike price, while a bearish contract is appropriate when you expect the price of the underlying asset to fall below the strike price.

In addition to choosing the direction of the contract, you should also consider the expiration time and strike price. For intraday options, such as the 30-minute options, the expiration time is the duration within which the option expires and the settlement period begins. Intraday options provide traders with an opportunity to take advantage of short-term price fluctuations and capitalize on market volatility within a specific timeframe. It's important to assess the volatility of the underlying asset during the chosen duration and make informed decisions based on the expected price movements. On the other hand, long-term options, which expire in at least 24 hours, allow for a longer assessment period and potentially capture more significant price trends. The strike price remains the same for both intraday and multiday options, representing the price at which the option can be exercised. By carefully considering the expiration time and strike price, and understanding the underlying asset's volatility, traders can make well-informed choices when trading both intraday and multiday options.

It's also important to consider the premium price for the option. This is the cost of the contract and represents the maximum amount that you can lose if the contract expires out of money. You should carefully consider the premium price and ensure that it fits within your risk tolerance and trading strategy.

By considering all of these factors and choosing the right contract, you can increase your chances of success when trading Easy Options.

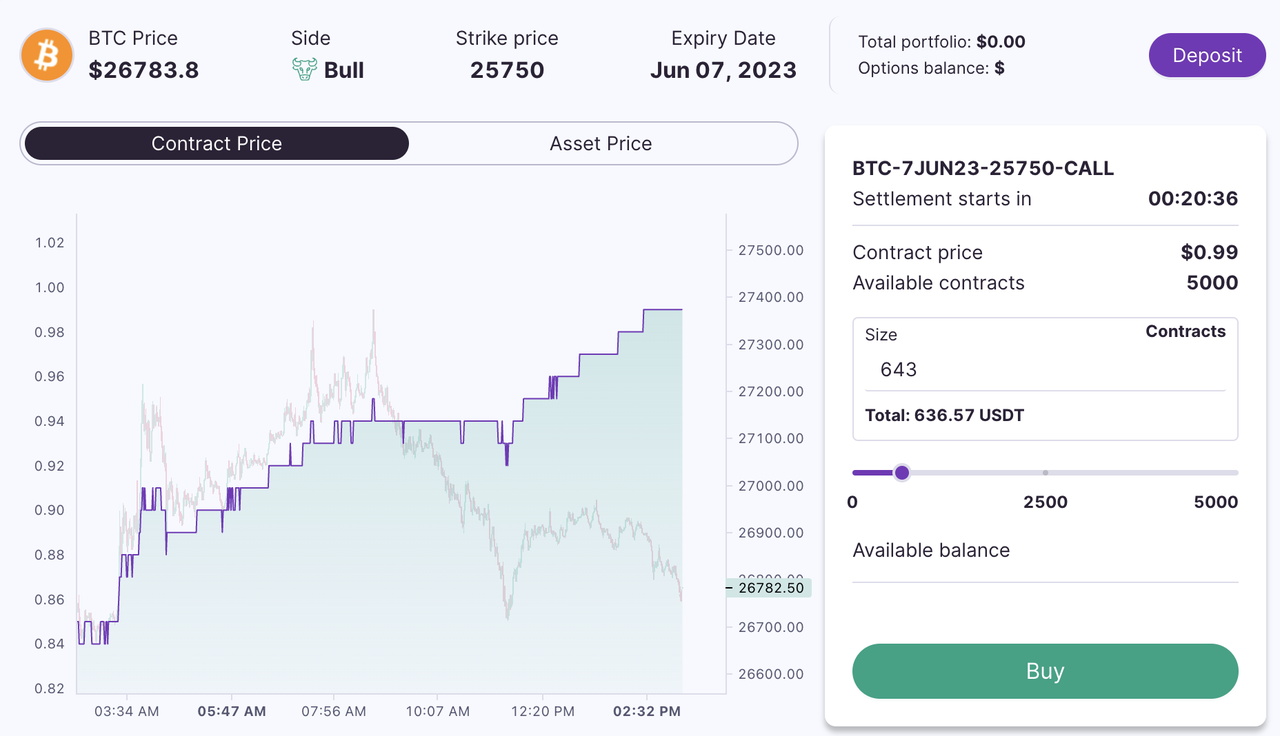

The above image indicates the necessary basic information about an option instrument when choosing one.

6. Placing an Easy Option Order

Once you've selected the right Easy option, it's time to place an order. Placing an order for an Easy option is straightforward and can be done in a few simple steps.

First, navigate to the Easy Options trading page on the AscendEX Platform. Next, select the asset you want to trade and choose the appropriate contract, taking into consideration the underlying asset, expiration date, strike price, total amount, and fees.

Then, enter the number of contracts that you want to buy or sell. Make sure to double-check that the information you have entered is accurate, as incorrect information can result in a loss.

After that, the system will execute the trade action immediately with the price at that time. Notably, due to network delay, orders may be rejected by the system if the price submitted deviates to some extent from the current option price, with the threshold being 5%.

Finally, confirm your order and wait for it to be executed. Once your order has been executed, you can track its performance in the "My Contracts" tab on the AscendEX Platform.

Placing an Easy Option order is quick and easy, and by following these steps, you can make informed trading decisions and manage your risk effectively.

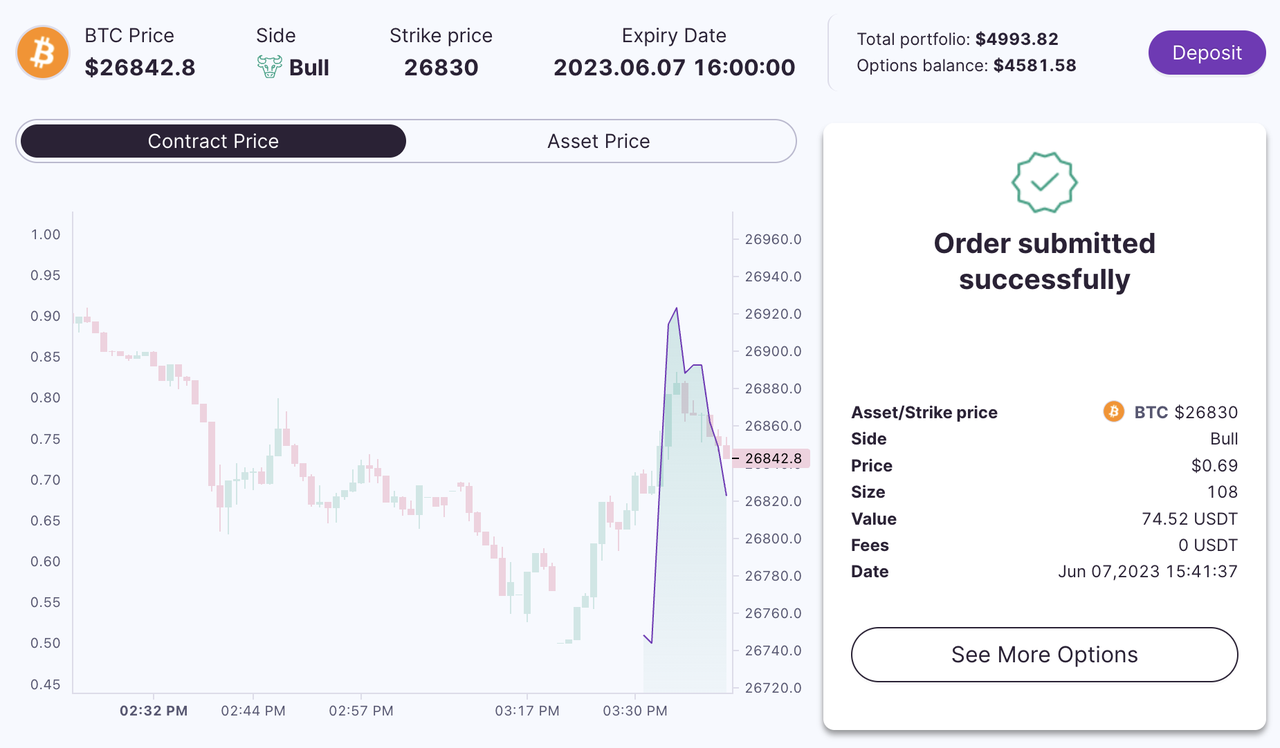

Double-check that all the information about the option order to be placed is correct in the interface shown above.

Confirm the feedback after the order.

7. Managing Your Easy Option Positions

Once you have placed an order for an Easy option, you can view it under the "My Contracts" tab on the Easy Options trading page. Here, you can manage your open positions, view your trading history, and monitor your profit and loss.

To manage your positions, you have several options. You can choose to close your position at any time before the settlement period by selling your contract back to the platform. Alternatively, you can hold your position until the settlement period ends, at which point your profit or loss will be automatically calculated and added to your account balance.

It's important to regularly monitor your positions to ensure that you are making informed trading decisions. You can track the performance of your positions in real time and adjust your strategy accordingly. If you have any questions or concerns about your Easy Option positions, don't hesitate to contact our customer support team for assistance.

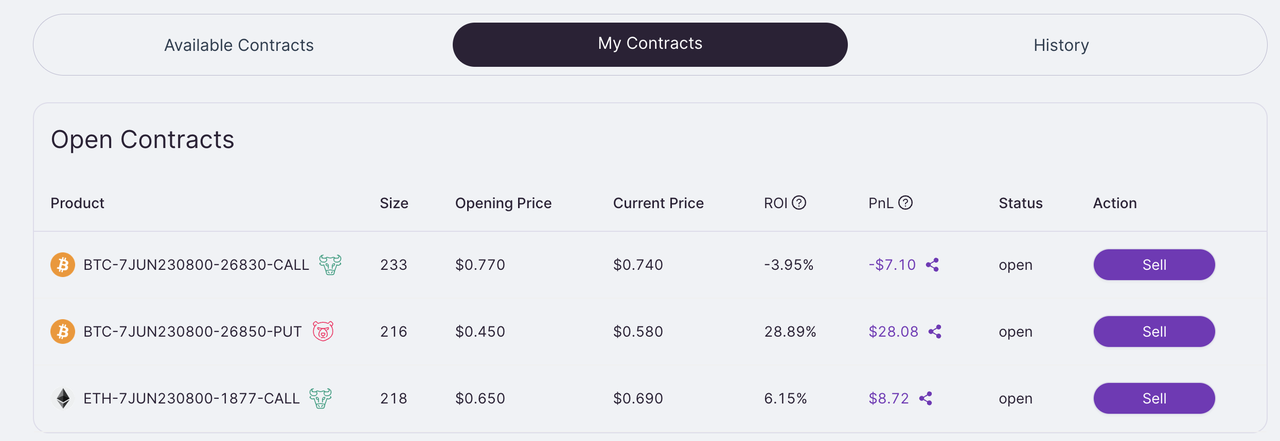

Under the "My Contracts" tab, one can manage currently opened positions, as well as view trading history, as shown above.

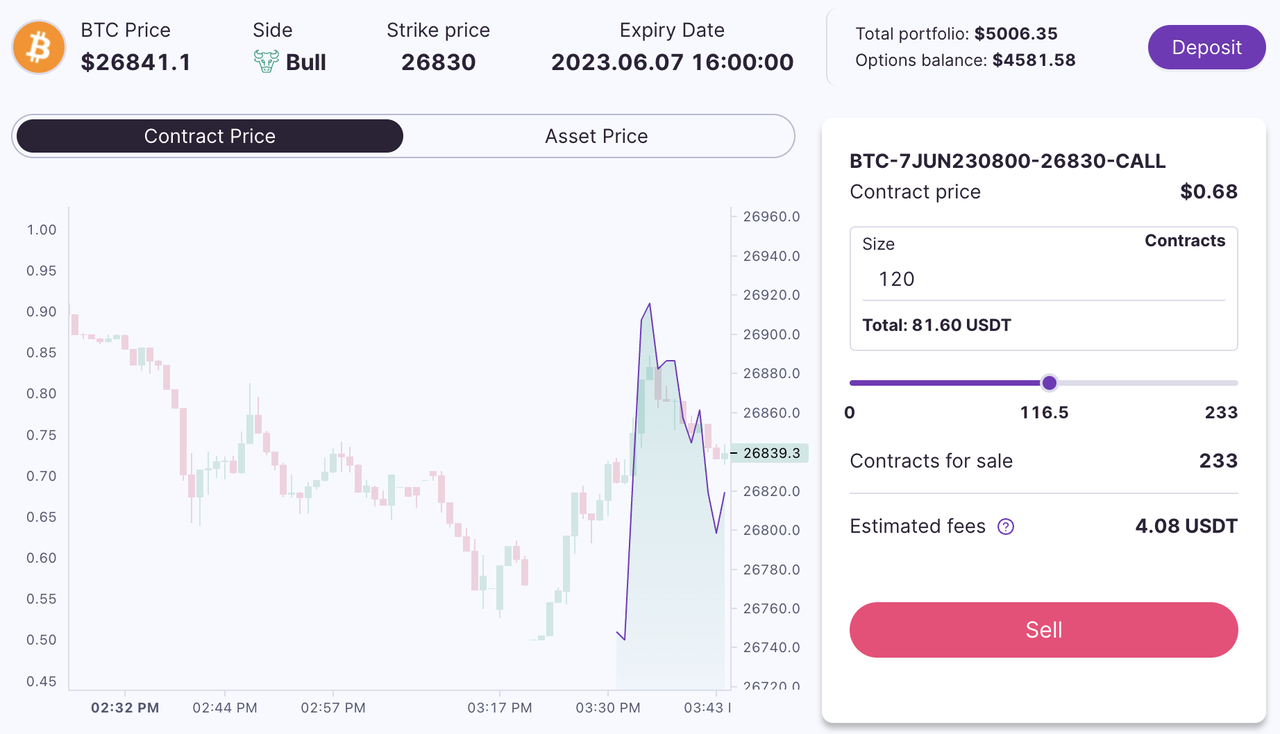

8. Selling Option

If you hold an Easy option and want to sell it before the expiration date, you can do so by placing a sell order on the AscendEX Platform. When you sell an option, the system will charge a trading fee equal to 5% of the total amount. The trading fee can be calculated using the following formula:

Trading fee = 0.05 x size

If you sell an option and make a profit, there will be an additional commission taken from the profit portion of the trade. The commission rate is also 5%. The commission can be calculated using the following formula:

Commission = 5% x (sell price - entry price) x size

It's important to note that if you sell an option at a loss, there will be no commission charged.

So the net profit is calculated as follows:

Net profit = Profit - Trading fee - Commission

When selling Option, it's important to remember that the price of the option may fluctuate. As always, it's important to make informed decisions based on your investment goals and risk tolerance.

By understanding the trading fees and commission structure for selling Option and using the formulas provided, you can effectively manage your costs and maximize your potential profits.

9. Settlement Periods and Calculation of Payouts

Multiday Options

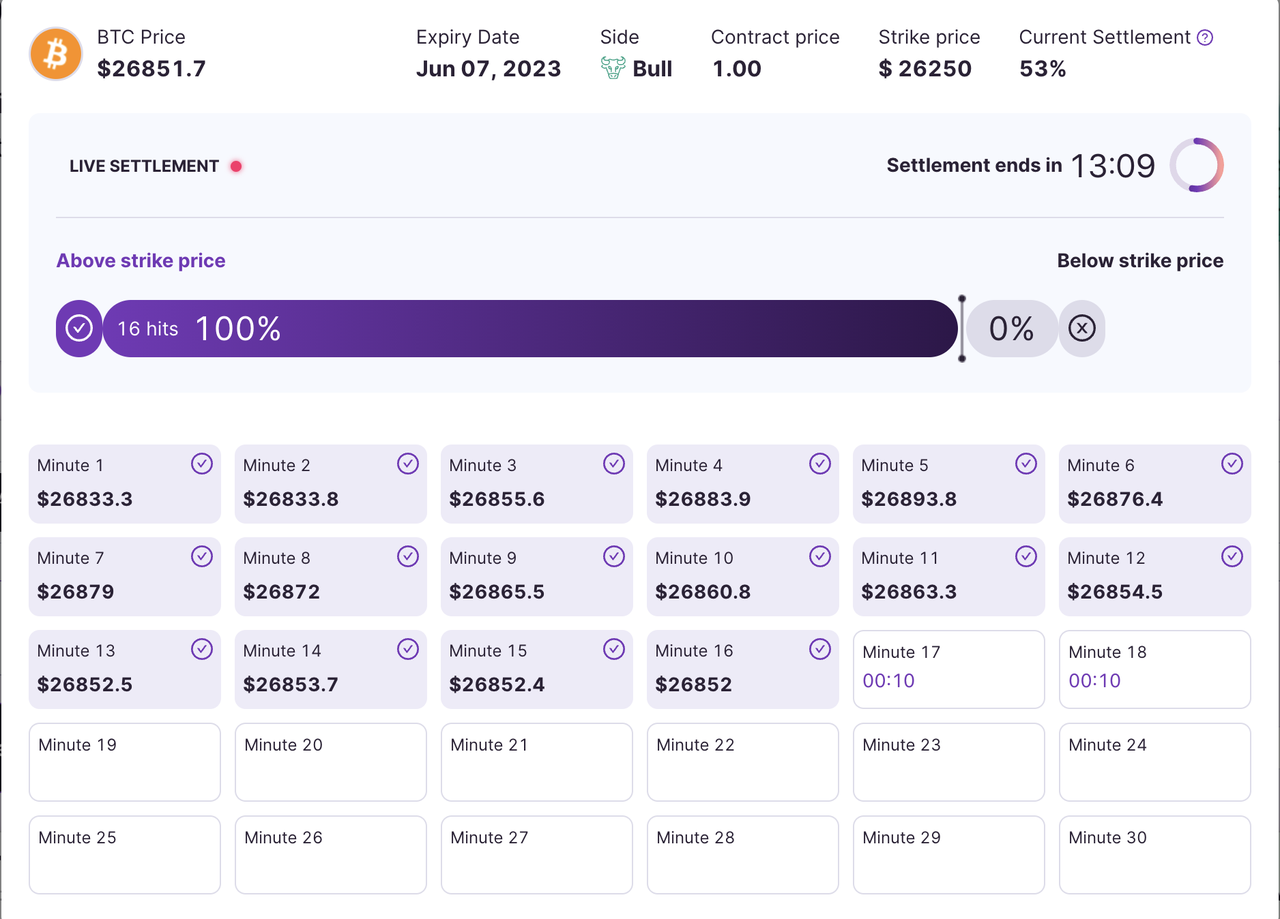

During the settlement period, which lasts for 30 minutes, the market price of the underlying asset will be compared to the strike price of the option 30 times for every minute. If the closing price of the underlying asset is above the strike price for a bull option (equivalent to call options in traditional option products), or below the strike price for a bear (put) option, the option is considered to have been exercised once, namely a hit. After the whole 30 minutes, the settlement price is calculated based on the number of hits, or the number of times the option was exercised, and the formula is:

Settlement price = # hits / 30 x $1

The payout calculation is based on the settlement price of the option and the size of the positions, with fees and commissions included. The calculated payout will be automatically added to the option holder's balance at the end of the settlement period. The payout is calculated using the fair market price of the underlying asset during the settlement period, with the fair market price being the weighted average price of the underlying asset from several cryptocurrency exchanges.

It is important to note that trading is disabled during the settlement period for all the options with that settlement time to ensure a fair and accurate calculation of payouts. Next-day options are not affected.

Intraday Options

For intraday options, such as the 30-minute options, the settlement process works slightly differently. Instead of having a separate settlement period, the outcome of the option is determined based on the price of the underlying asset at the expiration time. At the expiration time of the option, the settlement price is determined by comparing the strike price of the option to the current price of the underlying asset. If the underlying asset's price is above the strike price for a bullish option or below the strike price for a bearish option, the option is considered to be in-the-money and will be settled accordingly. Conversely, if the underlying asset's price is not favorable in relation to the strike price, the option will expire out-of-the-money.

Example 1

Suppose you bought a bull option for 100 shares of ABC at option price $0.5, with a strike price of $10 and a total investment of $50. During the 30-minute settlement period, the closing price of ABC was above the strike price 22 times out of the 30 one-minute intervals. Therefore, your option would have been exercised 22 times, resulting in a settlement payout of (22 / 30 x $1) x 100 = $73.3 (fees and commissions not included), and profit being $73.3 - $50 = $23.3, return rate 23.3 / 50 = 46.6%.

Example 2

Suppose you bought a bear option for 100 shares of XYZ, with a strike price of $50 and a total investment of $75. During the 30-minute settlement period, the closing price of XYZ was below $50 for 18 out of the 30 one-minute intervals. Therefore, your option would have been exercised 18 times, resulting in a settlement payout of (18 / 30 x $1) x 100 = $60 (fees and commissions not included), and profit being $-15.

10. Fees and Commissions

Fees and commissions are charged for actively selling options and waiting for settlement. The fee is $0.05 per share. For example, if you sell a contract at a price of $0.2 per share and the size of the contract is 1000 shares, the total amount would be $200. Therefore, the fee would be $50 (0.05 x 1000).

The commission for profits earned on options is an additional 5% taken from the profit portion of the trade. The profit is calculated as the sell price minus the entry price, multiplied by the size of the contract. If the sell price is lower than the entry price, the profit is zero, hence no commissions. For example, if you sell a contract at a price of $0.3 per share, and you initially bought it at $0.2 per share, and the size of the contract is 1000 shares, the profit would be $100. Therefore, the commission would be $5 (5% of $100).

Please note that fees and commissions apply both to actively selling options and waiting for settlement. The fee and commission will be deducted automatically from the payout.

Formulas for the calculations:

Fee = 0.05 x size

Commission = 5% x (sell price - entry price) x size

Net profit = Profit - Fee - Commission

Substitute "sell price" with "settlement price" when computing for settlements.

11. Risks and Limitations of Easy Options

Easy Options trading involves significant risks and limitations that traders should be aware of before participating. It is important to note that options trading is not suitable for all investors and traders, and past performance is not necessarily indicative of future results. The following are some of the risks and limitations of Easy Options trading:

1.Market Volatility: The value of options contracts can be impacted by a variety of factors, including market volatility, changes in interest rates, and economic events. These factors can cause significant fluctuations in option prices, which can result in substantial gains or losses for traders.

2.Limited Profit Potential: Easy Options have a fixed payout structure, meaning traders can only realize a fixed profit amount if the option is exercised successfully. This limits the potential profit that traders can achieve compared to traditional option products where the profit grows as the price deviates from the strike price.

3.Limited Time to Exercise: Easy Options have a limited time to exercise, and traders must be aware of the expiration date, even though settlements are automatically executed. Failure to do so will result in the option expiring out of the money, resulting in a loss for the trader.

4.Regulatory and Legal Risks: The regulatory environment surrounding digital assets and options trading is constantly evolving and can change quickly. Traders must remain aware of any regulatory developments that may impact their trading activity.

5.Trading Fees and Commissions: Trading fees and commissions are associated with buying and selling options contracts and can impact the overall profitability of a trade.

Traders should carefully consider these risks and limitations before engaging in Easy Options trading. It is recommended that traders conduct thorough research and analysis before making any trading decisions and consult with a financial advisor or professional before participating in this type of trading activity.

(2)How to Play

1. Funding your options account

Transfer USDT to your options account and get the balance to buy options contracts. Deposit and withdrawal fees are not charged.

2. Choose your option

Choose among our daily available contracts. Go bullish or bearish, select an asset, and a strike price. New contracts are released every day.

3. Trade options

Decide how many contracts of the selected option you’d like to buy and make your purchase. You can sell the options anytime before the settlement period begins. Trading fees and commissions are applied to both selling and settling options.

4. Follow the settlement and win

Watch for the live 30-minute settlement every day at 7:30 AM UTC. The more time the market stays on your side, the higher the settlement price will be. Payouts will be calculated based on the number of hits.

5. Claim your wins

After the settlement period ends, you will be awarded automatically in USDT with the calculation of your hits. You can track your performance in the “My Contracts” tab.